PPF Account: Know What It Is, Eligibility, Steps to Open & Benefits of Opening

If you’re looking for a secure and reliable way to save for your retirement or long-term financial goals, a Public Provident Fund (PPF) account might be the solution you’ve been searching for. In this article, we’ll demystify PPF accounts, walk you through the steps to open one, and highlight the numerous benefits they offer.

What Is It?

A PPF account, short for Public Provident Fund, is an Indian long-term savings and investment scheme endorsed by the government. It encourages individuals to save for retirement and other financial goals while offering tax benefits under Section 80C. The account has a 15-year lock-in period, extendable in 5-year intervals.

Contributions range from a minimum of Rs. 500 to a maximum of Rs. 1.5 lakh per year, with tax-free interest and eligibility for tax deductions. PPF provides safety, competitive interest rates, loan and partial withdrawal options, and flexible deposit methods. It’s accessible at post offices and various banks.

PPF can be extended indefinitely, allows nominee designation, and suits risk-averse investors and those aiming for long-term savings with tax advantages. It’s not open to NRIs initially, but they can maintain accounts if their status changes. Joint accounts aren’t allowed, and the interest earned is tax-free, making PPF a tax-efficient, long-term savings option.

Eligibility

Now that we know what is a PPF account, let’s get to the eligibility. Public Provident Fund accounts are accessible to resident Indians, including minors. However, there are a few conditions to keep in mind:

NRIs: NRIs who opened a Public Provident Fund account while they were resident Indians can operate the account until 15 years with no option for extension.

Minors: Minors can open a Public Provident Fund account based on legal age proof, with a birth certificate possibly required.

HUFs: HUFs (Hindu Undivided Families) cannot open Public Provident Fund accounts after May 13, 2005. Existing Public Provident Fund accounts prior to this date can be operated until maturity with no extensions.

Steps to Open

Online Method

To address how to open PPF Account, let’s look at the online method. Opening a Public Provident Fund account online is convenient, provided you have a savings account with a participating bank or Post Office with internet banking enabled. Here’s a step-by-step guide:

- Log into your internet banking or mobile banking account.

- Find the ‘Open a PPF Account’ option and select it.

- Choose ‘Self Account’ or ‘Minor Account’ based on your needs.

- Fill in the application form with relevant details and verify them.

- Specify the total amount you plan to deposit annually.

- Set standing instructions for automatic debits from your savings account to your Public Provident Fund account.

- Submit the application and authorize the transaction with the OTP sent to your registered mobile number.

- Congratulations! Your Public Provident Fund account is now created, and you’ll receive an email confirmation.

Offline Method

If you prefer a traditional approach, follow these steps:

- Fill out the Public Provident Fund application form with your details.

- Collect all required documents.

- Visit the bank or Post Office where you want to open the Public Provident Fund account (having an existing savings account there is recommended).

- Submit the documentation to the branch representative.

These ways will help you address how to open Public Provident Fund Account.

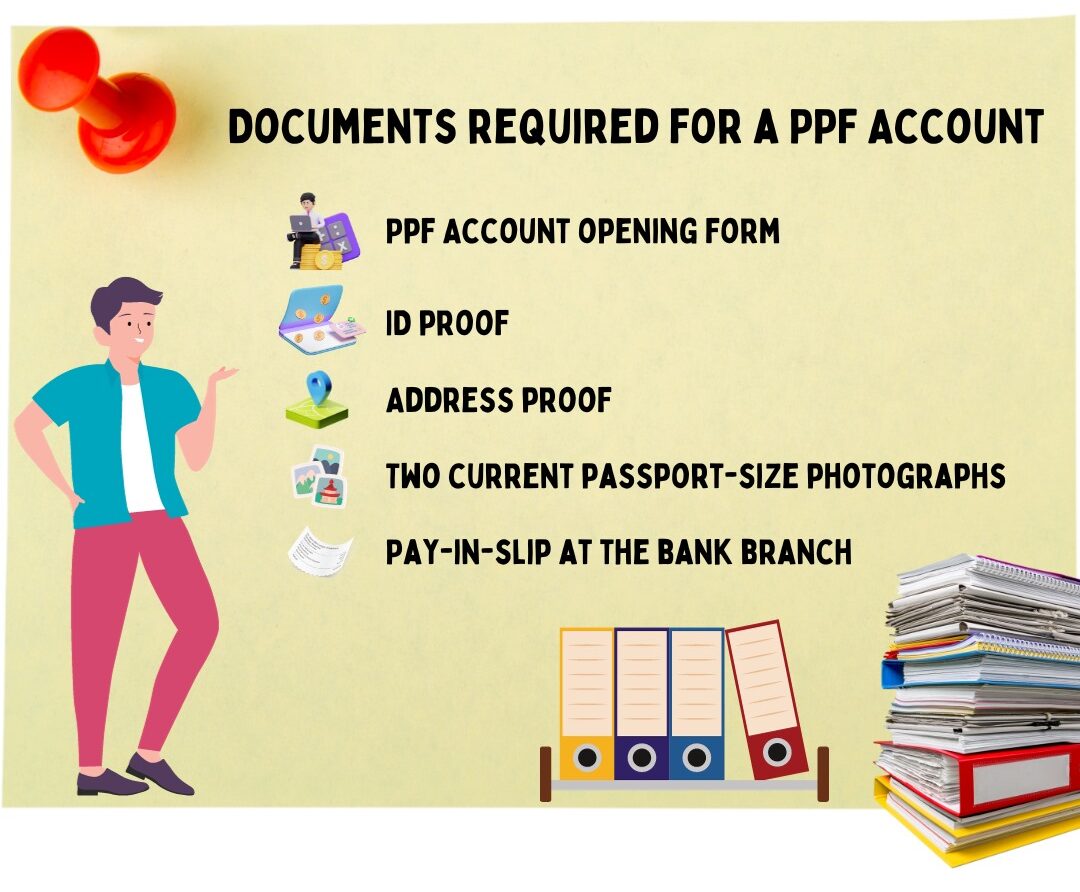

Documents Required

Let’s gather the necessary documents:

- Public Provident Fund Account opening form (available at bank branches or the Indian Post portal).

- ID proof (PAN card, driving license, voter ID card, passport, or Aadhaar proof).

- Address proof (telephone bill, electricity bill, ration card, or Aadhaar card).

- Two current passport-size photographs.

- Pay-in-slip at the bank branch or a signed cheque in favor of your Public Provident Fund account.

Remember to self-attest all documents, and carry the originals when opening the account.

Benefits of PPF Account

Opening a Public Provident Fund account comes with a multitude of advantages:

- Risk-Free Interest Rate: Enjoy an attractive interest rate of 7.1% p.a. on your investment, backed by the Central Government.

- Compounded Interest: The interest on your Public Provident Fund account is compounded annually, boosting your savings.

- Tax Deduction: Qualify for deductions of up to Rs 1.5 lakh on PPF investments under Section 80C of the Income Tax Act.

- Long-Term Investment: Commit to a 15-year investment horizon, ensuring a secure financial future.

- Loans Against Public Provident Fund Balance: You can avail loans between the 3rd to the 6th financial year from the account’s opening date.

- 6. Low Investment Threshold: Begin with a minimum deposit of Rs.500 per financial year, up to a maximum of Rs.1.5 lakh.

- Extension: Extend your Public Provident Fund account in blocks of five years after maturity.

- Withdrawal Facility: Access partial withdrawals from the 7th financial year onwards.

Now, we know what a Public Provident Fund account is, how to open one, and the benefits it offers. If we have any more questions or need further information, feel free to explore more or consult a financial expert. Remember, PPF can be a great savings tool for our future financial goals!

Frequently Asked Questions (FAQs): -

Can anyone open a Public Provident Fund account?

Yes, anyone can open a Public Provident Fund (Public Provident Fund) account as long as they are a resident of India.

Can Public Provident Fund account be opened for minor?

Yes, a Public Provident Fund account can be opened for a minor by their parent or legal guardian.

How to open Public Provident Fund account for minor in HDFC?

To open a Public Provident Fund account for a minor in HDFC, you’ll need to visit an HDFC branch, complete the required forms, and provide the minor’s birth certificate and KYC documents of the parent/guardian.

Are there any rules for opening a minor Public Provident Fund account?

Rules for opening a minor Public Provident Fund account usually involve the parent/guardian being the account holder, with the minor as a nominee. The account operates until the minor turns 18, and deposits should be made by the parent/guardian.