Personal Loans: What is it, 2 Types, Pros and Cons, How to Get it

Has it ever happened that an unexpected financial requirement comes up, but your bank account is unable to meet its requirement? From renovation to relocation expenses, there are several instances where you might need to fill up your funds. And that’s where personal loans come into the picture.

In times of need, when even your friends and relatives aren’t able to help you, this tool emerges as the saviour on the scene. Here we’ll cover everything about personal loans.

What’s Here For You?

– What is Personal loan?

– Types of Personal loan

– Pros and Cons of Personal Loans

– How Personal Loans Work

– How Can You Get a Personal Loan

– Business Loan vs Personal Loan

What is a Personal Loan?

A personal loan is when you get money from a bank or a lending company, just like when you borrow money from a friend. It’s money you can use for almost anything you need, like paying bills, buying a car, or going on vacation.

Here’s how it works: First, you apply for the loan by filling out some forms and providing information about your income and expenses. Then, if the bank approves your application, they give you the money you asked for. You agree to pay back the money over time, usually in monthly instalments, along with some extra money called interest.

Interest is like a fee you pay for borrowing the money. The bank charges interest to make some extra money for lending you the funds. The interest rate can vary based on factors like your credit score and how much you borrow.

Personal loans can be helpful when you need money quickly, but it’s important to borrow only what you need and make sure you can afford the monthly payments. If you don’t pay back the loan on time, it can hurt your credit score and cause financial problems. So, it’s essential to borrow responsibly and understand the terms of the loan before you agree to it.

Now that you know what a personal loan is, let’s take a look at the types of personal loans.

Types of Personal Loans

There are several types of personal loans to help you protect your belongings. Find each one of them below:

1. Secured Personal Loans

These loans require you to offer something valuable, like your car, savings account, or a certificate of deposit, as collateral. If you don’t pay back the loan, the lender can take the collateral to make up for the money you owe. Secured loans are often less risky for lenders, so they may offer lower interest rates.2. Unsecured Personal Loans

Unsecured loans don’t need any collateral, unlike secured loans. This means you don’t have to offer any valuable assets to borrow money. Because there’s no collateral to collect if you default on the loan, unsecured loans are riskier for lenders. As a result, they generally come with higher interest charges.

Both types of personal loans can be obtained from banks, credit unions, or online lenders, depending on your qualifications and credit history. It’s important to understand the terms and conditions of each type of loan before borrowing to ensure you can repay the loan on time and avoid financial difficulties.

So, to make your financial journey smooth, take the first step today. Pick your personal loan if you have a requirement. Now that you know about how personal loans work, let’s take a look at the difference between the pros and cons of personal loans.

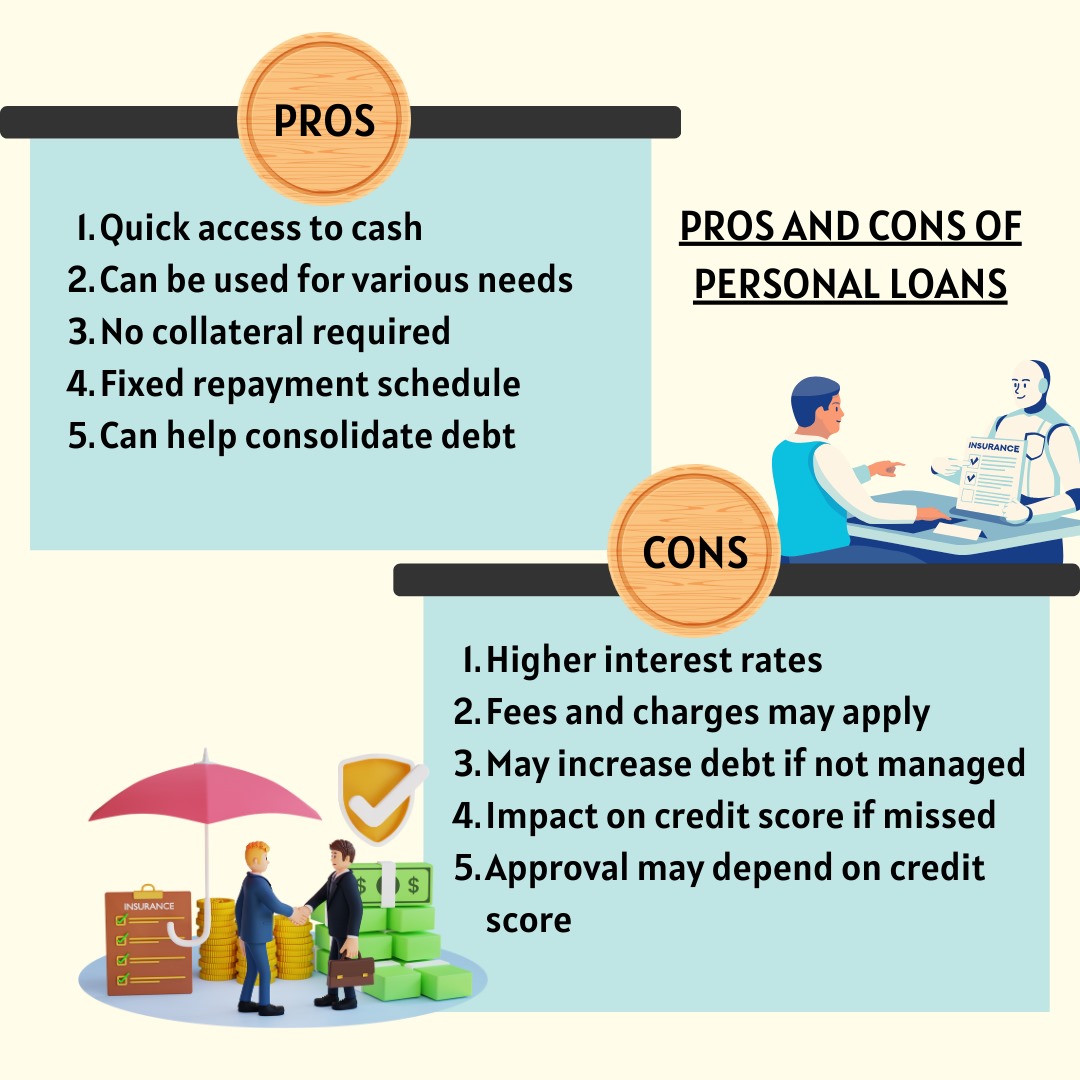

Pros and Cons of Personal Loans

Here is a detailed table on the pros and cons of personal loans.

|

Pros |

Cons |

|

Quick access to cash |

Higher interest rates |

|

Can be used for various needs |

Fees and charges may apply |

|

No collateral required |

May increase debt if not managed |

|

Fixed repayment schedule |

Impact on credit score if missed |

|

Can help consolidate debt |

Approval may depend on credit score |

As you decide on taking a personal loan, you should look at the advantages and disadvantages of it. Now let’s take a look at how personal loans work.

How Personal Loans Work?

Personal loans offer individuals a way to borrow money for various needs. To start the process, you apply with a lender, which could be a bank, credit union, or an online lender. Upon application, the lender assesses your information to determine approval.

If approved, you receive the loan terms outlining the amount, interest rate, and repayment schedule. You have the choice to accept or decline these terms. If you agree, you proceed to finalise the loan paperwork.

Once the paperwork is complete, the lender disburses the loan amount to you. This can be done through direct deposit into your bank account or via a check. With the funds in hand, you’re free to use them as necessary.

Repayment begins according to the terms specified in the loan agreement. This typically involves making regular payments over a set period, which includes both principal and interest.

Having a good idea of how personal loans work, let’s now take a look at how you can get a personal loan.

How Can You Get a Personal Loan?

Obtaining a personal loan can be a helpful solution when you need extra money for various expenses. Whether it’s for unexpected bills, home improvements, or consolidating debt, personal loans offer financial flexibility.

Here are simple steps to guide you through the process of getting a personal loan.

- Identify the amount of money you need and the purpose of the loan.

- Explore different lenders such as banks, credit unions, and online lenders.

- Compare interest rates, fees, and repayment terms to find the best option that suits your financial situation.

- Once you’ve chosen a lender, find and fill out the loan application form. Provide accurate personal information including your name, address, employment details, and income.

- The lender will review your application and conduct a credit check to assess your creditworthiness.

- If your application is approved, the lender will offer you loan terms including the amount, interest rate, and repayment schedule.

- If you agree to the terms, sign the loan agreement and provide any required documentation such as proof of income or identification.

- Once the paperwork is flised, the lender will disburse the loan funds to you.

These 7 easy steps will help you get an easy personal loan. Follow them and get a loan without hassle. But are you a business owner looking for a loan? If yes, the following section is for you.

What makes a Personal Loan different from a Business Loan?

As you already know by now, personal loans are designed for individual use, helping people cover personal expenses like medical bills, home renovations, or unexpected emergencies. But do you know what business loans are?

A business loan is money meant specifically for business needs. Entrepreneurs and business owners use business loans to fund startup costs, expand operations, purchase equipment, or manage cash flow. These loans are typically based on the financial health and creditworthiness of the business, rather than the individual owner.

Moreover, the terms and conditions of business loans and personal loans can vary significantly. Business loans often involve larger sums of money and may have longer repayment periods than personal loans. Interest rates and fees may also differ, with business loans sometimes carrying lower interest rates due to the lower risk associated with business borrowing.

Now you’re fully equipped to get a personal loan for yourself whenever the need arises. Remember, there will come several instances in your life where you’ll feel the need of a personal loan. But while making a financial planning journey, always consider the risks involved. Measure the pros and cons equally. And to make wise financial decisions, follow NewsCanvass.