6 Simple Steps For Free Credit Score Check

Can you check your credit score with no costs attached? You absolutely can. There are several websites and tools available online that help you do so. With a quick submission of basic information, like your name, address, and social security number, you’ll receive your credit score instantly or within a few minutes.

But are all the websites trustworthy? How to identify which one you should go for? Do regular free credit score check even help in your financial planning journey? We have got all of this and more covered in the following portion.

But, first let’s take a look at what credit score is and why it is important to check the credit score.

What is credit score?

Your credit score, which is usually between 300 and 850, shows how well you handle money. It looks at things like if you pay bills on time, how much debt you have, how long you’ve had credit, and what kinds of credit you have. This three-digit number serves as a quick snapshot of your financial health to lenders, helping them assess the risk of lending you money.

It’s crucial to understand that your credit score isn’t fixed; it can change over time based on your financial actions. By responsibly managing your finances, like paying bills on time and keeping credit card balances low, you can improve your credit score. Therefore, monitoring your credit score regularly allows you to track your progress and make informed decisions to maintain or enhance your financial standing.

Now let’s take a look at why checking your credit score is important.

Why is it important to check your credit score?

Checking your credit score is important because it gives you insight into your financial health. It determines your eligibility for loans, credit cards, or mortgages and impacts the interest rates you receive. We will cover more about this by the end of this guide.

But did you ever wonder what’s the right frequency of checking your credit score?

How regularly should one check their credit score?

You should check your credit score regularly, at least once a year, to catch any errors or signs of identity theft early. Regular monitoring helps you stay informed about your financial standing and gives you the opportunity to take steps to improve your score if necessary. So you know regularly checking credit score is important, but do you know if you can check it cost free?

Can you check your credit score for free?

Sure, you can see your credit score without paying anything. Lots of websites and banks let you check your credit score for free. It’s important to use reputable sources to ensure accuracy and protect your personal information. Checking your credit score regularly for free helps you stay informed about your financial health without costing you any money. So which websites offer free credit score check.

Which websites offer free credit score checks?

Some websites that offer free credit scores include:

1. Credit Karma

2. Credit Sesame

3. WalletHub

4. Experian

5. CRIF High Mark

6. Equifax

While checking your credit score for free is a good idea, It is also important to choose a trusted website to check your credit score and monitor your financial health regularly. So what steps do you need to follow for a free credit score check?

What Steps Need to be Followed for Free Credit Score Check?

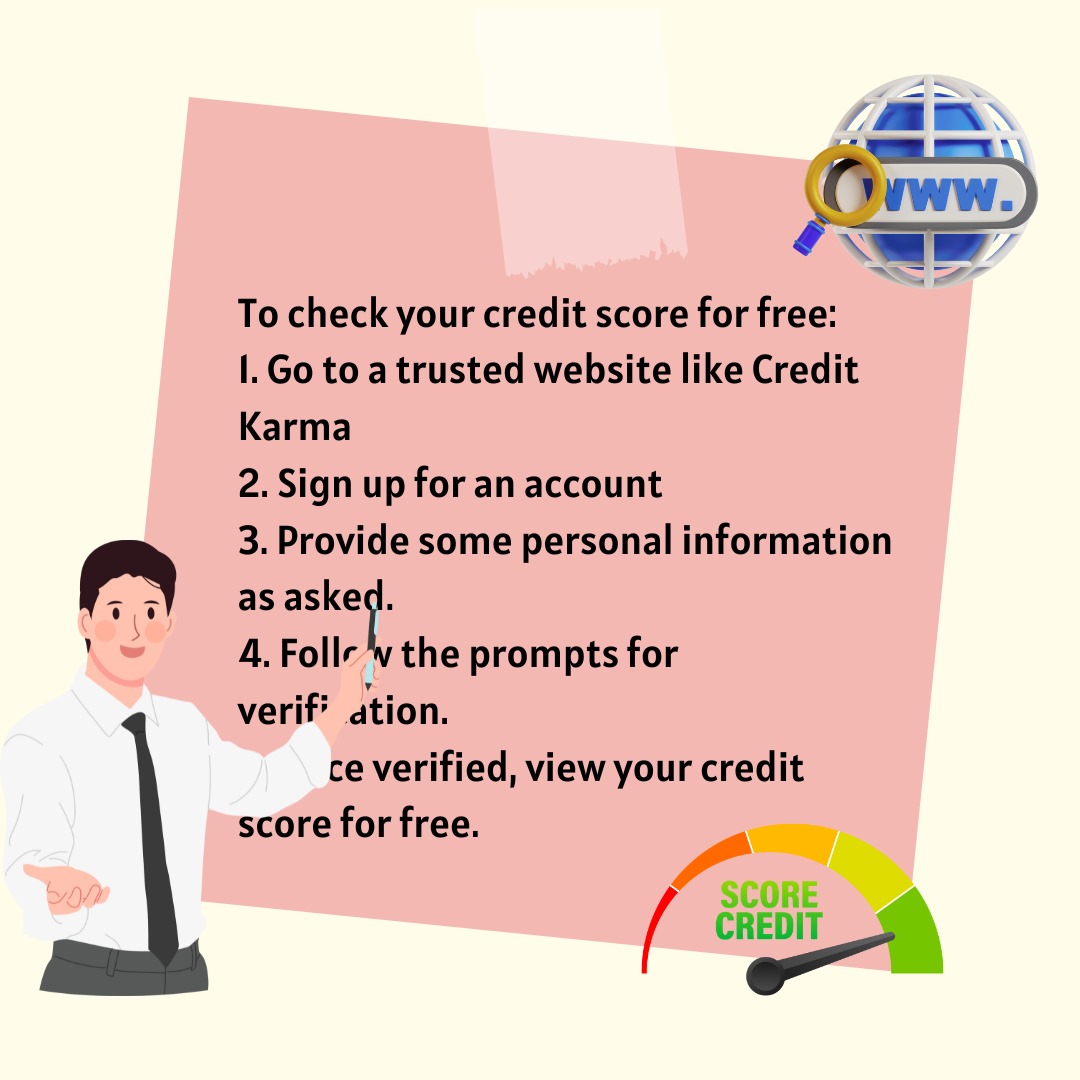

To check your credit score for free:

1. Go to a trusted website like Credit Karma, Credit Sesame, or WalletHub.

2. Sign up for an account with your email and create a password.

3. Provide some personal information like your name, address, and Social Security number.

4. Do what the instructions say to prove it’s really you.

5. Once verified, you’ll be able to view your credit score for free.

6. Check your credit score regularly to monitor your financial health and spot any changes.

Remember to pick a reliable website to safeguard your personal details and receive precise updates on your credit score.

Let’s now take a detailed look on how exactly regular credit score check can help you in your financial planning journey.

How Can Regular Credit Score Checks Help in Your Financial Planning?

Regular credit score checks are crucial for maintaining financial stability and planning effectively. They provide valuable insights into your financial health, helping you make informed decisions and take necessary actions to improve your overall financial well-being.

Understanding Financial Health

- Regular credit score checks allow you to gauge how well you’re managing money and debts.

- They provide a snapshot of your creditworthiness, indicating how likely you are to be approved for loans or credit cards.

Early Error Detection

- Checking your credit score regularly helps you identify any errors or inaccuracies in your credit report promptly.

- Detecting errors early allows you to dispute them and prevent potential negative impacts on your creditworthiness.

Improving Credit Score

- Watching your credit score helps you see how you’re doing with your money as time goes by.

- By identifying areas for improvement, such as paying bills on time or reducing debt, you can take proactive steps to enhance your credit score.

You understand how important it is to regularly check your credit score for financial planning. It gives you helpful details about your money situation, helps catch mistakes early, and lets you boost your credit score gradually. By staying on top of things and taking action, you can handle your finances well and aim for your money goals.

If you want to know more about how to invest, how to manage your finances, what tax planning is, and more, keep checking out NewsCanvass.