RBI MPC December Meeting: Key Announcements to Watch Amid Economic Challenges

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) is set to hold its fifth meeting for FY2024-25 from December 4 to 6.

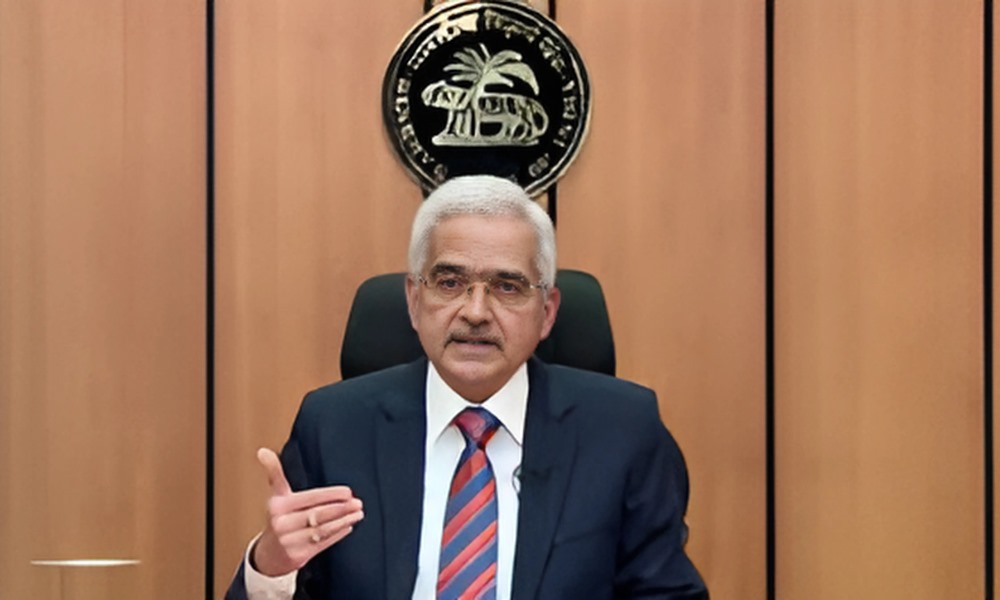

This bi-monthly meeting, led by Governor Shaktikanta Das, is significant due to the backdrop of economic challenges like slower GDP growth, persistent inflation, and declining production levels.

The key decisions, including the repo rate announcement, will be disclosed on Friday, December 6, at 10:00 AM.

Meeting Overview and Schedule

The December MPC meeting follows previous sessions held in April, June, August, and October, with the final FY25 meeting planned for February 2025.

Announcements from this session will be streamed live on RBI’s YouTube, Facebook, and X (formerly Twitter) platforms. A press conference will follow at 12:00 PM.

While the RBI has maintained the repo rate at 6.5% over the last nine meetings, experts are divided on whether this trend will continue. Balancing economic growth with inflation control remains the central bank’s primary concern.

Economic Challenges in Focus

The December meeting takes place amidst several pressing economic concerns:

- GDP Slowdown: India’s Q2 GDP growth declined to 5.4%, a seven-quarter low, significantly below the typical 6-7% range.

- Rising Inflation: Retail inflation hit 6.21% in October, marking a 14-month high.

- Declining Production Levels: Reduced industrial output has contributed to overall economic weakness.

These factors have heightened public and industry expectations for corrective measures.

Key Speculations and Expert Opinions

Economists and analysts are speculating on the policy decisions the RBI might adopt to navigate these challenges.

Possibility of Rate Cuts

Nomura predicts that the RBI could initiate an aggressive rate-cutting cycle, starting with a 25-basis-point reduction in the repo rate and a 50-basis-point cut in the Cash Reserve Ratio (CRR).

Aurodeep Nandi, India Economist at Nomura, sees this as a necessary response to the economic slowdown.

“When inflation forecasts are anchored at 4-4.5% and GDP growth shocks at 5.4%, the RBI must act proactively with forward-looking monetary policies,” Nandi explained.

Focus on Liquidity Measures

Mandar Pitale, Head Treasury at SBM Bank India, believes that the RBI might focus on durable liquidity measures rather than immediate rate cuts.

He suggests phased reductions in CRR or open market operations (OMO) as potential steps to enhance liquidity.

Benefits of Stability

On the other hand, Atul Monga, CEO of BASIC Home Loan, expects the repo rate to remain unchanged. He points out that stable interest rates have supported housing demand, particularly in mid-range and luxury segments.

Key Areas of Interest

Observers are closely watching the following aspects of the MPC’s decisions:

- Repo Rate: Speculations lean toward the rate remaining steady at 6.5%.

- Liquidity Adjustments: Potential changes to CRR or OMO policies to address liquidity issues.

- Inflation Strategy: Insights into how the RBI plans to tackle persistent inflationary pressures.

Highlights of the October Meeting

The October MPC meeting maintained the repo rate at 6.5% for the 10th consecutive session. This decision aligned with the committee’s priority of controlling inflation amidst global economic uncertainties.

During that meeting, the MPC projected GDP growth for FY25 at 7.2% and inflation at 4.5%. The session also marked the introduction of three new external members, bringing fresh perspectives to the panel.

Broader Economic Context

The economic slowdown and inflationary pressures make this December meeting particularly critical.

Experts like Emkay Global Financial Services suggest that while the case for a rate cut exists, the RBI may rely on non-conventional measures like liquidity easing.

They propose a CRR reversal to pre-COVID-19 levels of 4%, which would release approximately ₹1.2 trillion into the system. However, the timing of such measures depends on the MPC’s confidence in balancing inflation, growth, and currency stability.

Where to Watch the Announcements

For live updates and announcements, you can follow:

- RBI Official Website: The official repository for policy decisions and meeting minutes.

- Social Media: Follow RBI on YouTube, Facebook, and X for live streams.

- News Platforms: Major financial news outlets will provide comprehensive coverage.

Looking Ahead

The MPC’s decisions on December 6 will shape India’s monetary policy amid a challenging economic environment.

Whether the central bank opts for immediate rate cuts or focuses on liquidity measures, its actions will influence inflation control, GDP growth, and overall economic stability.

As the February 2025 meeting approaches, the December session will set the tone for future monetary strategies. Observers and stakeholders alike await the policy announcements to gauge the RBI’s approach to navigating these complex economic dynamics.