Fixed Deposit Vs Life Insurance – Which Is Better For You?

Investment landscape can sometimes be a maze with a multitude of available options and alternatives. And if you’re new to the world of investment, you must have come across two popular choices – fixed deposits and life insurance (both of which promise safety and wealth creation).

But it boils down to fixed deposit vs life insurance – which one suits you better? Let’s take a closer look.

Life Insurance vs Fixed Deposits: Key Differences

The fundamental contrast lies in their purpose.

Fixed deposits cater to your investment needs, while life insurance aims to secure your family financially in case of unexpected events.

When deciding, consider your goals. Fixed deposits work for short and long-term plans, guaranteeing returns you can predict. On the flip side, life insurance, especially ULIPs, ties returns to market changes, making them less predictable.

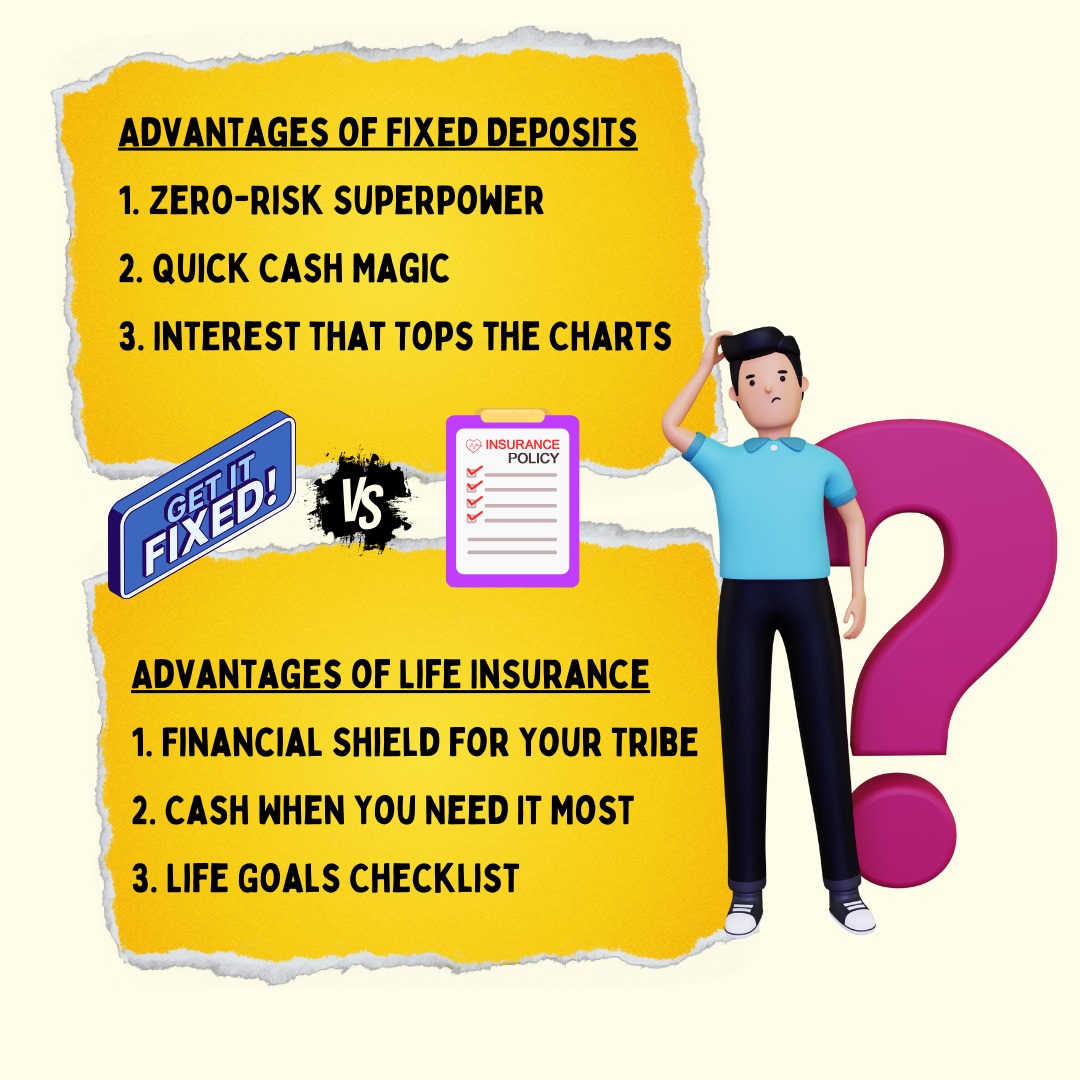

Advantages of Fixed Deposits

Now that you know the definitions of fixed deposit vs life insurance, let’s analyse the advantages of fixed deposits.

- Zero-Risk Superpower:

Fixed deposits are like a financial fortress, offering guaranteed returns with almost zero risk. Your money stays safe, and you still earn a tidy sum. Plus, with the recent boost in insurance, it’s even more secure.

- Quick Cash Magic:

Need your money back in a jiffy? No worries! Fixed deposits make it easy to cash out, and even though there might be a tiny penalty, it’s a quick and painless process. Online banking makes it a breeze.

- Interest that Tops the Charts:

Forget the modest interest in your regular savings account. Fixed deposits strut in with higher interest rates – some banks even dish out a generous 7% or more. Now, that’s some serious cash growth!

- Bank BFF Benefits:

Think of your fixed deposit as your golden ticket to a great relationship with your bank. It’s not just about saving; it’s about building ties that can score you premium services and sweet deals when you need a loan.

- Tax-Saving Magic Trick:

Here’s the bonus round – fixed deposits can be your tax-saving wizards. You get to shave off a chunk from your taxable income under section 80C. Just remember, the magic lasts for a mandatory 5-year period.

- Instant Account Opening Spell:

Want to join the fixed deposit league? It’s as easy as pie! Pick a trustworthy bank, submit your KYC docs, and voilà – a new fixed deposit account is born. Just click a few buttons online, and you’re good to go!

So, there you have it – all the advantages of fixed deposits.

Advantages of Life Insurance

On the other hand, we have life insurance. The following advantages of life insurance will give you a better picture of fixed deposit vs life insurance – which is better for you?

- Financial Shield for Your Tribe:

Life insurance steps in like a financial guardian angel for your family. If something happens to you, it cushions the blow by covering debts, living expenses, and medical or final costs. It’s like having a safety net for life’s unexpected curveballs.

- Cash When You Need It Most:

Your life insurance isn’t just a piece of paper; it’s a promise. When you’re not around, your family gets a lump sum – no waiting, no strings attached. And guess what? That payout is usually tax-free. It’s like a financial gift from above.

- Life Goals Checklist:

Figuring out insurance doesn’t have to be rocket science. Set your goals, know how much coverage you need, and find a policy that fits your budget. Pro tip: A financial pro can make this a breeze, explaining the nitty-gritty and helping you tailor it to your needs.

- Guaranteed Protection:

If you’ve got people depending on you – family, business, or others – a whole life policy acts like a safety net. It guarantees a lump sum payout to your beneficiaries, provided you keep up with the premiums.

- Income Lifesaver:

Ever wondered what would happen if your income vanished? Whole life insurance steps in to make sure your loved ones can keep the lights on, pay the mortgage, tackle childcare expenses, cover tuition, and more.

- Tax-Free Bonus:

The money your beneficiaries get? It’s all theirs. Life insurance benefits usually skip the federal income tax queue, giving your loved ones the full amount you intended.

So, these are the pertinent advantages of life insurance you need to have in your mind while making a judgement about whether you should go for life insurance or fixed deposit.

Types of Fixed Deposits

Now that you’re aware of the advantages of both life insurance and fixed deposits, take a look at the types of fixed deposits:

- Standard Fixed Deposit: Traditional plan with fixed interest rates.

- Tax-Saving Fixed Deposit: Offers tax benefits, with a lock-in period.

- Special Fixed Deposit: Higher interest for specific tenures.

- Regular Income Fixed Deposit: Ideal for monthly interest payouts.

- Senior Citizen Fixed Deposit: Higher rates for individuals over 60.

These 5 key types of fixed deposits will come in handy while understanding the landscape of life insurance vs fixed deposits.

Types of Life Insurance Plans

- Retirement Plans: Build post-retirement wealth with tax-free returns.

- Child Insurance Plans: Financial tool for building a corpus for a child’s future.

- Whole Life Insurance: Coverage for 99 years with guaranteed income on maturity.

- Money-Back Insurance Policy: Regular payouts at intervals for short-term goals.

- Endowment Plans: Guaranteed returns with life coverage and bonus payouts.

- Unit Linked Insurance Plans (ULIPs): Life cover with market-linked returns.

- Term Insurance Plans: Vital for primary wage earners, providing affordable protection.

These 7 types of life insurance plans will help you decide whether life insurance plans are meant for you.

Factors You Should Consider While Choosing Between Fixed Deposits vs Life Insurance

In fixed deposits or life insurance, each option comes with its own set of advantages and considerations, and understanding these factors is crucial for making informed choices.

Let’s look at each factor separately:

- Risk Tolerance:

Assess your risk tolerance before deciding between fixed deposits and life insurance. Fixed deposits offer a lower risk with guaranteed returns, while life insurance may involve market-linked risks but could provide additional benefits like coverage and returns linked to market performance.

- Financial Goals:

Consider your financial goals and timeline. Fixed deposits are suitable for short to medium-term goals with a stable return, whereas life insurance, especially investment-linked policies, might align better with long-term financial objectives due to the potential for wealth accumulation.

- Liquidity Needs:

Evaluate your liquidity needs. Fixed deposits usually have a fixed tenure, and premature withdrawals may incur penalties.

Life insurance policies may offer more flexibility, but surrendering them early could impact returns. Choose the option that aligns with your liquidity requirements.

- Insurance Coverage:

If protection is a priority, life insurance provides a dual benefit of savings and coverage. Fixed deposits lack life coverage. Consider whether you need life insurance for protection or if your primary focus is on saving and earning interest, in which case fixed deposits might be more suitable.

FD vs Life Insurance – Which is Better?

Here, we have enumerated the advantages of FD and life insurance, types of life insurance, and the factors you should consider while choosing between FD and life insurance.

Now, the decision hinges on your needs. If you seek stable returns, fixed deposits are a strong contender. However, if managing risk and ensuring financial safety for your family is paramount, a life insurance plan might be the better fit.